Unlock Low Interest Personal Loans: Our Top Tips

Did you know a good credit score can save you thousands on interest with a personal loan? With the right strategies, you can find the best low interest personal loans. Getting a low interest rate personal loan is key today.

We’ll show you our top tips for the best loan terms. A high credit score and stable income matter a lot to lenders. By boosting your financial health, you can get low interest personal loans more easily.

Key Takeaways

- Understanding the importance of credit scores in securing low interest rates.

- The role of income in determining loan eligibility.

- Tips to improve your credit score for better loan terms.

- Strategies to increase your income to qualify for low interest loans.

- How to navigate the loan application process effectively.

Understanding Low Interest Personal Loans

Low interest personal loans are a great choice for those who qualify. They offer financial help at a lower cost than usual loans.

What Are Low Interest Personal Loans?

Banks, credit unions, and online lenders offer low interest personal loans. They have competitive personal loan rates that help make borrowing cheaper. These loans give people the money they need for things like debt consolidation, big purchases, or unexpected bills, at a lower rate than usual.

Key Features and Benefits

Low interest personal loans have affordable monthly payments and flexible repayment terms. These make it easier to handle your money while paying back the loan. The main perks include saving on interest over time and having predictable payments due to fixed rates and schedules.

Here are some key benefits:

- Lower interest rates than credit cards or other high-interest loans

- Flexible repayment terms that fit your financial situation

- The chance to boost your credit score by paying on time

How They Differ from Other Loans

Low interest personal loans are different from other loans, like payday loans or high-interest installment loans. They have low APR personal loans. Unlike high-interest loans that can trap you in debt, low interest personal loans are more friendly to borrowers. They offer lower interest rates, making them a good choice for those needing financial help but avoiding high-interest borrowing.

Importance of a Good Credit Score

Knowing the value of a good credit score is crucial for getting low interest personal loans. A high credit score means you’re more likely to get a loan with better terms. We’ll look at how your score affects interest rates and share tips to boost it.

How Credit Scores Affect Interest Rates

Your credit score plays a big role in the interest rate you’ll get on personal loans. Lenders see high scores as a sign of less risk. This means they offer better rates to those with excellent scores.

For example, someone with a top credit score might get a loan at 6%. But, if your score is lower, you could face rates of 12% or more.

Here’s a simplified example of how credit scores can impact interest rates:

| Credit Score Range | Interest Rate | Loan Terms |

|---|---|---|

| 750-850 | 6% | Favorable |

| 700-749 | 7%-8% | Good |

| 650-699 | 9%-12% | Moderate |

| Below 650 | Above 12% | Less Favorable |

Tips for Improving Your Credit Score

To boost your credit score, you need to be financially disciplined and smart about credit. Here are some tips:

- Always pay your bills on time. Payment history is key to your score.

- Pay down your debts, like credit card balances.

- Check your credit report often to spot and fix errors.

- Don’t apply for too many new credits at once. It can hurt your score.

By sticking to these tips and keeping a good credit score, you’ll have a better shot at low interest personal loans. Remember, improving your score takes time and effort.

Preparing to Apply for a Personal Loan

Before we apply for a personal loan, we must check our financial health. This step helps us figure out the best loan for us.

We start by looking at our finances. This means checking our income, expenses, savings, and debts. Knowing our financial health helps us decide if we can repay the loan.

Evaluating Your Financial Situation

Creating a budget is key when applying for a personal loan. We track our income and expenses to see where our money goes. This helps us find ways to save more for loan repayment.

Checking our credit report and score is also important. A good score can help us get online personal loans with low interest. We should look for errors in our report and work on improving our score.

Knowing Your Loan Amount Requirements

Finding the right loan amount is crucial. We need to know exactly how much we need to borrow. This could be for debt consolidation, a big purchase, or unexpected costs.

We make a list of our financial goals and estimate their costs. This helps us choose the right loan amount. It ensures we’re not borrowing more than we need.

By carefully checking our finances and figuring out our loan needs, we’re ready to apply. We know we’re making a smart choice that fits our financial situation.

Comparing Lenders for the Best Rates

Comparing lenders is a key step in finding the best personal loans. There are many lenders with different loan options. It’s important to look at each one carefully.

Traditional Banks vs. Online Lenders

Borrowers often choose between traditional banks and online lenders for personal loans. Traditional banks offer security and the chance to negotiate rates if you have an account there. But, their loan process can be slow.

Online lenders are fast and convenient, with quick approval and money transfer. They might have better rates for those with good credit. But, you might miss out on personal service and could face higher fees.

What to Look for in a Lender

When picking a lender, look at the interest rates and fees. Even small differences in APR can change the loan’s total cost a lot.

Also, think about the repayment terms. Loans with flexible repayment can be easier to handle. Plus, good customer service and a smooth borrowing experience are important.

- Evaluate the lender’s reputation and customer reviews.

- Check for any additional fees, such as origination fees or late payment fees.

- Consider the loan’s flexibility, including the ability to make extra payments or pay off the loan early without penalty.

By comparing lenders and looking at these factors, you can find a personal loan that fits your needs and has a good rate.

The Loan Application Process

Getting a low-interest personal loan starts with a well-prepared application. We’ll show you the steps and documents needed for a smooth process.

Required Documentation

To apply for a personal loan, you’ll need some documents. These include:

- Identification: A valid government-issued ID, like a driver’s license or passport.

- Income Verification: Recent pay stubs, W-2 forms, or tax returns to show your income.

- Credit History: Your credit report, which lenders may ask for with your permission.

- Employment Verification: Your employer’s contact info to confirm your job.

- Bank Statements: Recent statements to prove your financial stability and account details.

Having these documents ready can make the application process smoother. It’s also crucial to ensure the information is correct and up-to-date to avoid delays.

Common Application Mistakes to Avoid

Mistakes on the application can cause delays or rejection. Common errors include:

| Mistake | Impact | Prevention |

|---|---|---|

| Inaccurate Information | Delays or rejection due to discrepancies. | Double-check all information for accuracy. |

| Incomplete Application | Application may be rejected or put on hold. | Ensure all required fields are filled. |

| Poor Credit History | Higher interest rates or loan rejection. | Check your credit report and address any issues before applying. |

Knowing these common mistakes and how to avoid them can help your application succeed. It’s also wise to review the lender’s specific needs and tailor your application to fit.

Interest Rates and Terms Explained

When you look at low interest rate personal loans, it’s key to get the interest rates and loan terms. These two parts greatly affect the loan’s cost.

Interest rates show how much you’ll pay to borrow money. Loan terms show how long you’ll have to pay it back. A lower interest rate can save you money over time. But, the loan term also matters, as longer terms can mean more interest paid.

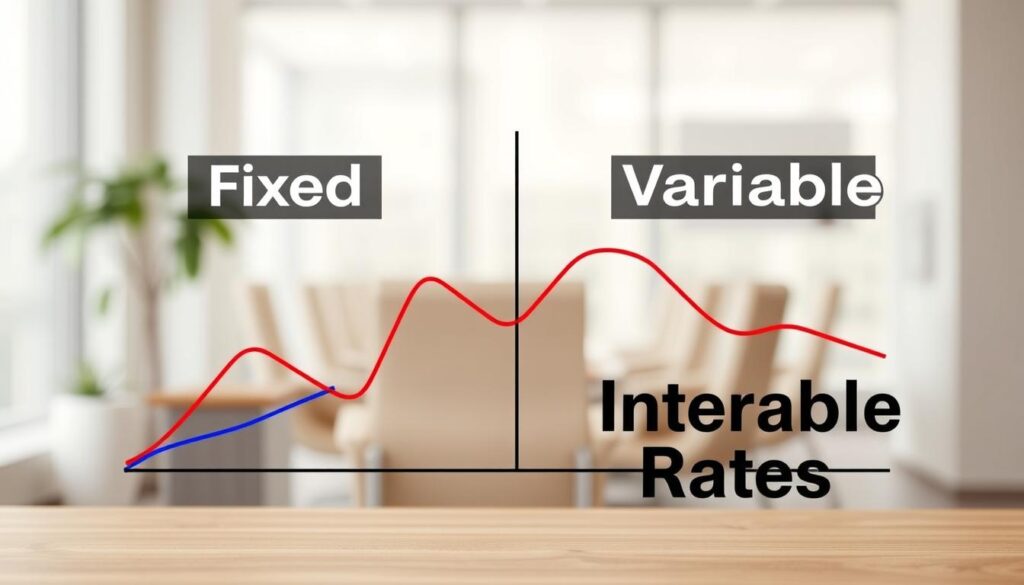

Fixed vs. Variable Interest Rates

When applying for a loan, you’ll decide between fixed and variable interest rates. A fixed interest rate stays the same, making your payments predictable.

A variable interest rate can change with the market, affecting your payments. Variable rates might start lower but could go up, so think about your finances and risk.

For example, a fixed 6% rate on a $10,000 loan for five years means steady payments. But, if you pick a variable rate starting at 5% but goes to 7% after two years, your payments could increase, affecting your budget.

Understanding Loan Terms and Their Impact

Loan terms, from a few months to years, are crucial for the loan’s total cost. A longer term means lower monthly payments but more interest over time.

On the other hand, a shorter term means higher payments but less interest. It’s a choice that depends on your finances and goals.

“The key to making an informed decision is understanding how interest rates and loan terms interact to affect the total cost of your loan.”

Understanding these concepts helps you navigate personal loans better. You’ll make a choice that fits your financial goals.

Strategizing Loan Repayment Plans

Repaying your low interest personal loan doesn’t have to be hard. With a good plan, you can manage your money well.

Creating a loan repayment plan is key to handling your debt. It means knowing your finances, setting achievable goals, and picking the best ways to reach them.

Creating a Budget for Repayment

To begin, make a budget that includes your loan repayment. Track your income and expenses to see how much you can pay each month. Use the 50/30/20 rule as a guide: 50% for needs, 30% for wants, and 20% for savings and debt.

Focus on paying off your debt by using most of your 20% for your loan. This way, you’ll pay off your loan faster and save on interest.

Exploring Additional Payment Options

Also, look into extra payment options to pay off your loan quicker. Try making bi-weekly payments instead of monthly ones. This adds up to an extra payment each year, cutting down your loan term.

- Make extra payments when you can, like with a tax refund or bonus.

- Check out refinancing options if interest rates have gone down since you got your loan.

- Use online tools or talk to a financial advisor to find the best repayment plan for you.

Additional Costs to Consider

There are more than just interest rates to think about with personal loans. It’s important to know about fees associated with personal loans. This helps you figure out the total cost of borrowing when looking at low APR personal loans.

Fees Associated with Low Interest Loans

Even with low interest rates, personal loans can have extra costs. Some common fees include:

- Origination fees, which are charged when the loan is issued

- Late payment fees, incurred if a payment is missed or delayed

- Prepayment fees, which some lenders charge if the loan is paid off early

- Application fees, which may be required when applying for the loan

These fees can differ a lot between lenders. It’s key to check the loan terms well. For example, an origination fee can be from 1% to 8% of the loan amount, affecting the total cost.

Understanding the Total Cost of Borrowing

To get the full picture of borrowing costs, look at both interest rates and fees. The Annual Percentage Rate (APR) shows the loan’s total cost. It includes the interest rate and some fees.

Here’s how to figure out the total borrowing cost:

| Loan Amount | Interest Rate | Origination Fee | Total Cost |

|---|---|---|---|

| $10,000 | 6% | 2% | $10,200 + interest |

| $5,000 | 8% | 1% | $5,050 + interest |

Knowing the total borrowing cost helps you make better choices. It’s not just the interest rate. It’s the whole cost, including fees.

Situations When Low Interest Loans Make Sense

Low interest personal loans are great in certain situations. They offer financial relief and flexibility. This makes them a good choice for people facing financial challenges or looking for opportunities.

Managing multiple debts is one key scenario where low interest loans shine. Debt consolidation combines several debts into one. This often means a lower interest rate and one monthly payment.

Debt Consolidation

Using a low interest personal loan for debt consolidation can simplify your finances. It can also save you money on interest. For example, if you have high-interest credit cards, a low interest loan can lower your total interest and make payments easier.

- Simplify your finances with a single monthly payment.

- Potentially lower your overall interest rate.

- Reduce the stress associated with managing multiple debts.

Financial experts say, “Consolidating debt into a low interest loan can be a smart move. It helps you take control of your finances and work towards being debt-free.”

“Consolidating your debts into one loan with a lower interest rate and a single monthly payment can make it easier to manage your finances and reduce your stress levels.”

Major Purchases and Investments

Low interest personal loans are also good for major purchases or investments. They can help with home renovations, education, or unexpected expenses. This way, you get the funds you need without overstretching your budget.

For instance, a low interest loan for home improvements can increase your property’s value. Financing education through a low interest loan can also boost your career and earnings.

When thinking about a low interest personal loan for big purchases or investments, check the potential return. Make sure the loan terms match your financial goals.

- Assess the potential return on investment for the loan amount.

- Compare loan offers from different lenders to secure the best rate.

- Consider the repayment terms and ensure they fit within your budget.

Common Misconceptions About Low Interest Loans

Many people think low interest personal loans are not good. But, they are actually very helpful. They can be a great choice if you know how to use them.

Low interest personal loans are often misunderstood. But, they can be a great financial tool for those who know how to use them. Let’s look at some common myths and facts about these loans.

Debunking Myths

Some think you need perfect credit for a low interest loan. But, credit is just one thing lenders look at. They also check your income, debt, and job history.

- Lenders also look at income stability, debt-to-income ratio, and employment history.

- Some lenders offer loans to individuals with less-than-perfect credit, albeit at slightly higher interest rates.

- Shopping around and comparing offers from multiple lenders can help you find the best rates available to you.

Another myth is that applying for a low interest loan is hard. But, many lenders have easy online applications. You can apply in just a few minutes.

Realities of Low Interest Borrowing

It’s important to know the truth about low interest loans. Here are some key points:

- Interest rates can vary a lot between lenders, so it’s key to compare them.

- Low interest loans often have flexible repayment terms. This means you can pick a plan that works for you.

- It’s important to know about any fees with the loan. These can change how much you pay in total.

By knowing the truth about low interest personal loans, you can make better choices. Whether you’re paying off debt or buying something big, these loans can help. Just use them wisely.

Resources for Finding Low Interest Personal Loans

Finding the right resources is key to getting online personal loans with low interest. There are many tools and guides to help you. They make it easier to understand the process and make smart choices.

Utilizing Online Comparison Tools

Online comparison tools let you see what different lenders offer. This makes it simple to find low interest loans. You can look at rates, terms, and fees from various lenders. For example, Discover Personal Loans has APRs from 7.99% to 24.99%.

Leveraging Government Resources and Guides

Government resources are full of helpful info on managing debt. They explain the impact of borrowing and why a good credit score matters. Using these resources can help you understand your financial options better.